Just received this e-mail from Prosper...

Subject: Live in MD and want to invest on Prosper? Here’s how.

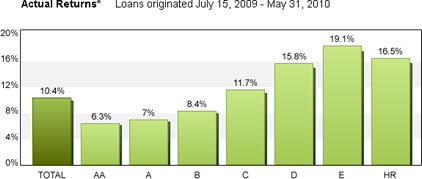

Since 2009, Prosper Lenders have been enjoying 10.4% annual returns.*

A best-in-class credit risk model and improved verification procedures have helped Lenders to earn better returns than ever before:

Actual Return chart July to May

And now you can participate by working with a Registered Investment Advisor (RIA).

William Jordan Associates, Inc. has a track record of investing in the Prosper marketplace, and has recently established services dedicated to working with investors who want to participate in Prosper Notes. By working with this California-based RIA, investors like you now have access to our consumer loans marketplace which has experienced double-digit growth in the last year.

If this opportunity interests you, consider contacting William Jordan Associates directly to learn more:

William Jordan Associates, Inc.

23332 Mill Creek, #260

Laguna Hills, CA, 92653

(949) 380-8600

www.WilliamJordanAssociates.com/prosperWant to learn more about recent performance of the Prosper marketplace?

Check out our new Marketplace Performance page to see detailed return data by Prosper Rating or read our recent Blog posts about risk and return performance.

Regards,

Prosper

NOTE: William Jordan Associates, Inc. is not affiliated with Prosper Marketplace, Inc. For more information regarding working with a Registered Investment Advisor please contact William Jordan Associates, Inc., directly.

* Net Annualized Returns represent the actual returns on Borrower Payment Dependent Notes ("Notes") issued and sold by Prosper since July 15, 2009. To be included in the calculation of Net Annualized Returns, Notes must be associated with a borrower loan originated more than 10 months ago; this calculation uses loans originated through May 31, 2010. To calculate Net Annualized Returns, all payments received on borrower loans corresponding to eligible Notes, net of principal repayment, credit losses and servicing costs for such loans, are aggregated then divided by the average daily amount of aggregate outstanding principal for such loans. To annualize this cumulative return, the cumulative number is divided by the dollar-weighted average age of the loans in days and then multiplied by 365. Net Annualized Returns are not necessarily indicative of the future performance of any Notes. All calculations made as of March 31, 2011.

Author

Topic: Prosper workaround to allow lenders in all states (Read 317220 times)

Author

Topic: Prosper workaround to allow lenders in all states (Read 317220 times)