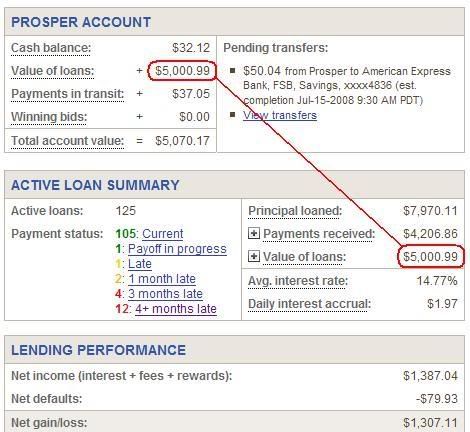

Every time I look at my Prosper account this irritates me anew.

See that nice (nearly round) $5,000 account value? Well, that's bogus. Complete bullcrap. I remember the early days, when pensioner still gave interviews and posted in the (old) forums. He was questioned on his lates and defaults and optimistically mentioned that his account value was still greater than the money he put in. Poor man, he was as deceived as most of us probably are.

In my (and in everyone else's) account value is included not only the full outstanding principal value of all late loans, but also the accumulated interest on these self-same late loans.

So, simply taking my 12 4+ lates that include 4 bankruptcies and 3 loans that Prosper has already brought back from the collections agencies since their announcement that they won't sell these loans (due to a combination of an unacceptably low price and unacceptable conditions imposed by prospective buyers), there is a grand total of $612.02 in unpaid principal included in that total. But it gets worse. Prosper is kindly increasing my account value on a monthly basis with the accumulated interest on these dead, lifeless loans. So, in total, there is already a princely sum of $696.12 in my account value that is, for all intents and purposes less useful than monopoly money.

Check back next month and my account value will be inflated even more with dead money. Money that exists nowhere except in Prosper's accounting system.

Take this a step further. Prosper kindly shows me a net gain/loss figure (bottom of the image above). Looks nice, don't it? I've made a nice $1,300 on Prosper. Uh no. Wait a second. Deduct the $696 from that and I've made a much less respectable $604. And don't forget those other 7 loans drifting slowly and inexorably down to the 4+ month late category. They are in that lovely account value too, and they too are "earning" interest on a monthly basis to swell the pool of dead money in my account.

The way things stand now, if all my loans defaulted to 4+ months late overnight, then my account value on Prosper would remain unchanged in the short term and would show a steady increase over time as they accumulate more unrecoverable interest and late fees.