The

Motley Fool recently published an

article that picked up on an issue that has been

hotly debated here and also

highlighted in Fred93's blog. This has to do with the way Prosper represented it's status to the courts in an ID theft/bankruptcy case comprising a Prosper borrower.

In a

blog article, Prosper admits that it represented its relationship to the borrower (and by implication the relationship of Prosper "Lenders") incorrectly to the court and that it will soon file amendments to correct this mischaracterization.

However, a very interesting thing happened in this blog entry. Some lenders were complaining about the failed debt sales and Prosper's decision to bring these loans in-house rather than sell them off to

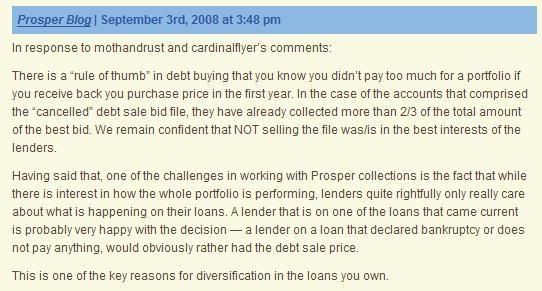

JDBs. Prosper responded as follows:

Note the very interesting statement:

"In the case of the accounts that comprised the “cancelled” debt sale bid file, they have already collected more than 2/3 of the total amount of the best bid."When Prosper provided the

update on the debt sale process (correctly phrased, this should be "announced the cancellation of the debt sale"), I wrote about it

here.

In a post in the thread, I provided an estimate of the putative offers that were turned down. My estimate was that Prosper turned down an offer in the region of $232,000 for the $6.6 million of eligible debt. Based on the response in the blog post, Prosper has apparently recovered in the region of $153,000 by using their own "post-charge off collection techniques."

I'd be interested to hear from any of the lenders who shared in this bounty. I know I'm not one of them.

Which brings me to another point in the above post. Prosper once again extols the virtues of diversification:

"A lender that is on one of the loans that came current is probably very happy with the decision — a lender on a loan that declared bankruptcy or does not pay anything, would obviously rather had the debt sale price.

This is one of the key reasons for diversification in the loans you own."

In the normal JDB, all the lenders shared in the proceeds of the JDB. THis way, the results are spotty. I'm undecided if this is a good thing or a bad thing. Obviously, since the vast majority of lenders isn't seeing a penny from these collections, they might be thinking this is sub-optimal and not in the spirit of the originally agreed-to Lender agreement.

Author

Topic: Prosper "succeeding" with "post-charge-off collection techniques?" (Read 12384 times)

Author

Topic: Prosper "succeeding" with "post-charge-off collection techniques?" (Read 12384 times)